“With mortgage regulation being much tighter now and, in particular, self-certification being banned, the risks are much less than [they were] 10 years ago,” he explains.

“It should also be remembered that the prime reason for the banking crisis was the US subprime market, in which UK banks invested, not UK residential mortgage lending, either prime or subprime.”

A statement from trade association UK Finance acknowledges the role of regulation in helping to make the subprime, or credit impaired, market a safer and more robust sector for lenders and borrowers alike.

“The mortgage industry has successfully implemented regulatory and other safeguards to guarantee that their customers borrow only what they can afford to repay,” a UK Finance spokesperson states.

“2014’s Mortgage Market Review banned self-certification mortgages, tightened the rules around interest-only mortgages and required affordability to be checked more stringently.”

This was followed by the European Union’s Mortgage Credit Directive in 2015 which also put greater pressure on lenders and brokers to show proof of earnings and suitability.

Largely, the tougher rules around mortgage affordability appear to be working.

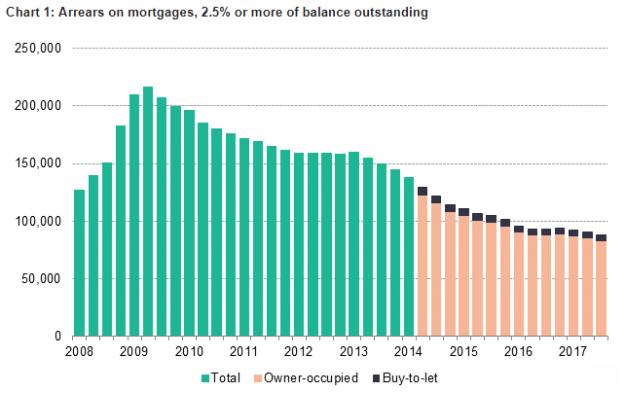

In November 2017, UK Finance reported that the number of mortgages in arrears of 2.5 per cent or more of the outstanding balance fell again in the third quarter (see chart 1 below).

Source: UK Finance

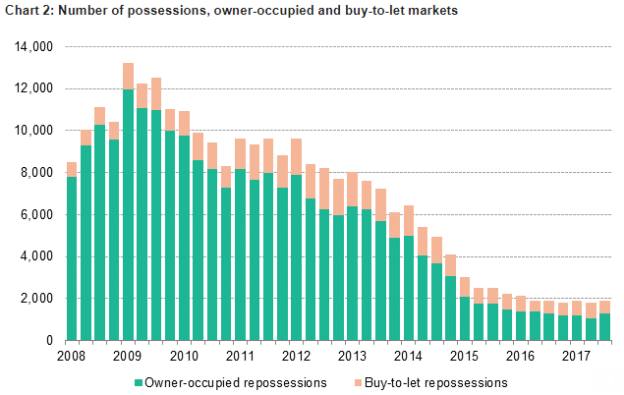

However, it confirmed that cases of repossession increased, albeit from an historically low level.

It reported: “At 88,300 the number of loans in arrears was 2 per cent lower than in the second quarter of the year (90,400) and at its lowest level since this run of data began in 1994.”

But the number of properties taken into repossession (referred to by UK Finance as 'possessions') in the third quarter of 2017 was 1,900 (see chart 2 below), or the same total as in the first three months of the year.

Source: UK Finance

In a press release, UK Finance’s head of mortgages policy, June Deasy, said: “Even a small rise in mortgage [re]possessions is disappointing but, after a long period of declining numbers, it was inevitable that they would rise again at some stage.”

Signs to watch for

What are the signs to watch out for should a potential crisis loom again and which types of borrowers would be most at risk?

Mr Boulger says: “Those with small deposits will be most at risk as they will have fewer options if they run into any difficulties, but this risk is mitigated by virtue of the fact that relatively large deposits are required for an adverse credit mortgage.